Campers for Finance Near Me Your Guide

Campers for finance near me: Finding the perfect mobile home for your financial goals starts with understanding your needs. This guide explores various search intents, from those seeking a short-term rental to long-term ownership, considering factors like location and time of year. We’ll also delve into the features and benefits of different types of financial campers, highlighting key criteria for evaluation and comparing models based on price, features, and capacity.

Beyond the specifics of camper types, we’ll investigate local providers near you. This includes dealerships, rental companies, and a breakdown of buying vs. renting. We’ll equip you with the tools to navigate local options and understand pricing models, empowering you to make informed decisions. Finally, we provide a clear and comprehensive approach to presenting this information in a user-friendly format, using visuals, tables, and FAQ sections to enhance your understanding and address any questions you might have.

Understanding the Search Intent

Understanding the intent behind searches for “campers for finance near me” is crucial for optimizing content and providing relevant information to potential customers. This involves recognizing the various needs and motivations driving these searches, as well as the different user profiles and their specific circumstances. Analyzing search patterns across different locations and periods can further refine our understanding of the nuances of this search query.

Different Search Types

This section details the various ways people might phrase their search for “campers for finance near me”. Recognizing these variations is essential for ensuring that our content effectively addresses the diverse needs of potential customers. Different search terms reflect various degrees of specificity and information sought.

- Specific make and model: Users might search for “Airstream campers for finance near me” or “Winnebago camper loans near me.” This indicates a specific camper type they desire, signifying a higher level of pre-planning and a clear idea of the type of camper they want to acquire.

- Budget-oriented searches: Searches like “affordable camper financing near me” or “low-interest camper loans near me” prioritize cost and affordability. These users are likely more price-sensitive and seek financing options that align with their budget constraints.

- General inquiries: Searches like “campers for financing near me” or “camper loan options near me” indicate a broader interest in the financing process for campers. This suggests they are in the initial stages of their camper-buying journey and seeking general information.

- Location-specific searches: Searches might include city names like “campers for finance in San Francisco” or “RV financing in Austin.” These searches emphasize the geographical location, demonstrating a desire to find options near them.

User Profiles

This section profiles the types of people who might utilize the search term “campers for finance near me.” Understanding these diverse profiles helps to tailor our content to their specific needs and motivations.

- First-time camper buyers: These users are likely new to camping and are researching financing options to afford their first camper. They may be looking for guidance on the entire process, including interest rates and terms.

- Experienced campers seeking upgrades: These users may have a camper already and are looking for financing options to upgrade to a newer or more luxurious model. They may have a clear idea of their needs and are seeking specific financing options.

- Families planning a camping trip: These users may be looking for campers that can accommodate their family’s needs and are exploring financing options to support their camping adventure. They might emphasize features such as space and amenities.

Location Considerations

The availability and terms of camper financing can vary significantly based on location. Understanding these variations is vital to providing relevant information.

- Geographic differences in interest rates: Interest rates for camper financing can vary by region due to factors like local economic conditions and the prevalence of financing options.

- Availability of financing options: Some areas might have more camper financing options available compared to others. This could be due to the concentration of RV dealerships and financial institutions.

- Local regulations and policies: Local regulations can influence the financing process, impacting terms, fees, and eligibility requirements.

Seasonal Variations

Search intent and user motivation can fluctuate throughout the year.

- Summer peak: Summer is a popular time for camping, and searches for camper financing near me will likely increase during this period. Users might be motivated by upcoming vacations or weekend getaways.

- Off-season interest: During the off-season, searches might be driven by pre-planning for future trips or potentially lower financing rates available during this period.

Summary Table

| Search Type | User Profile | Motivation | Location Considerations |

|---|---|---|---|

| Specific make and model | Experienced or pre-planned buyers | Desire for specific features and aesthetics | Availability of specific models and financing in the area |

| Budget-oriented | First-time buyers or budget-conscious users | Affordability and the lowest interest rates | Local interest rates and availability of financing options |

| General inquiries | Potential buyers researching the process | General understanding of financing options | Local regulations and policies |

| Location-specific | Buyers looking for options nearby | Convenience and local access | Proximity to dealerships and financing providers |

Identifying Relevant Financial Campers: Campers For Finance Near Me

Financial campers, also known as recreational vehicles (RVs), are specifically designed for financial management and investment strategies, are gaining popularity. Understanding the features and costs associated with these unique vehicles is crucial for informed decision-making. This section delves into the characteristics, types, evaluation criteria, and financial considerations for potential buyers.

Common Features and Benefits of Financial Campers

Financial campers, while not designed for camping, often offer a lifestyle conducive to financial freedom. Key features include modular design, adjustable layouts, and built-in storage solutions. These features, coupled with energy-efficient appliances and sustainable materials, can significantly reduce operating costs. These campers are particularly appealing to individuals or families seeking to optimize their finances and travel while minimizing expenses.

Different Types of Financial Campers

Several brands and models cater to different needs and budgets. While a “financial camper” isn’t a formally recognized category, certain RVs are frequently employed for financial strategies. These often include smaller, fuel-efficient models or vehicles with high-end modular components. Examples include certain models from prominent RV manufacturers like Winnebago or Thor, which might offer adaptable spaces or high-tech systems that contribute to long-term cost reduction. Customizable options further enhance the appeal for financial management.

Key Criteria for Evaluating a Financial Camper

Evaluating a financial camper requires careful consideration of various factors. Crucial criteria include fuel efficiency, the cost of maintenance, and the vehicle’s potential for long-term value appreciation. Also important are the features that facilitate financial optimization, such as space utilization and modularity. The availability of aftermarket support and potential for customization also significantly impact long-term financial viability.

Comparison of Financial Camper Models

| Model | Price (USD) | Features | Capacity |

|---|---|---|---|

| Model A (Basic) | $50,000 | Standard amenities, basic modularity | 4-6 people |

| Model B (Mid-Range) | $75,000 | Enhanced modularity, solar panels, water conservation features | 6-8 people |

| Model C (Luxury) | $120,000 | Premium appliances, high-tech systems, expanded storage | 4-8 people (depending on layout) |

This table provides a simplified comparison. Actual prices and features vary widely based on specific models, options, and manufacturers

Financial Factors to Consider When Purchasing a Financial Camper

Purchasing a financial camper involves a substantial upfront investment. Beyond the purchase price, consider ongoing maintenance costs, insurance premiums, and potential fuel expenses. Consider the potential for the camper to generate income, such as rental opportunities or use as a mobile workspace. Analyzing these financial factors ensures a sound investment decision.

Cost Breakdown of Owning a Financial Camper

| Expense Category | Estimated Cost (Annual) |

|---|---|

| Purchase Price | $50,000 – $120,000+ (depending on model) |

| Maintenance | $1,000 – $3,000 (depending on usage and maintenance schedule) |

| Insurance | $500 – $1,500 (depending on coverage and vehicle value) |

| Fuel | $1,000 – $5,000+ (depending on usage and fuel efficiency) |

| Utilities (if applicable) | $500 – $1,500 (depending on usage and location) |

Note: These are estimated costs and can vary based on individual circumstances and usage patterns.

Analyzing Local Campers for Finance

Finding the right financial camper provider near you involves careful consideration of various factors, including the specific needs of your business and the available options in your local area. Understanding the pricing structures, services offered, and the overall advantages and disadvantages of different providers is key to making an informed decision.

Potential Financial Camper Providers

Local providers offering financial campers can encompass a wide range of businesses, from established dealerships to specialized rental companies. Identifying these providers requires a targeted approach, focusing on companies that cater to the needs of businesses looking for financing solutions related to campers.

Types of Businesses Offering Financial Campers

A range of businesses offer financial assistance for campers. These include:

- RV Dealerships: Many RV dealerships offer financing options directly to customers. They often have established relationships with lenders and can provide competitive rates. They are typically equipped to handle the full process, from application to final paperwork.

- Rental Companies: Some rental companies may offer financing options, especially for longer-term rentals or customized arrangements. This can be a flexible option for businesses needing access to campers without the commitment of a purchase.

- Financial Institutions: Banks, credit unions, and other financial institutions might offer financing for campers, though they often work with dealerships or require a higher credit score. These institutions typically focus on providing comprehensive financial solutions.

- Specialized Financial Companies: Some specialized financial companies focus exclusively on providing financing options for campers and other recreational vehicles. They often cater to specific needs and may offer unique terms.

Examples of Local Dealerships and Rental Companies

Identifying local dealerships and rental companies specializing in camper financing can be achieved through online searches using s like “RV financing near me,” “camper rental financing,” or similar phrases. Looking through online directories and reviewing business reviews can help you narrow down options. Contacting potential providers directly can help ascertain if their financing options are a good fit for your business.

Pricing Models of Different Providers

Pricing models for financial campers vary significantly. Some providers offer fixed interest rates, while others might offer variable rates. Important factors to consider include the term of the loan, the down payment required, and any associated fees. Comparison shopping is crucial to ensure you are getting the most competitive rates.

Comparing interest rates, down payments, and associated fees across different providers is essential for making an informed decision.

Advantages and Disadvantages of Buying vs. Renting

Buying a camper provides the ownership of the asset and the ability to customize it to your specific needs. Renting offers flexibility and a lower initial investment, but you don’t gain ownership or customization options. Consider your long-term needs and financial capacity when making this decision.

- Buying: Advantages include ownership, customization, and potential long-term cost savings. Disadvantages include higher initial investment, potential maintenance costs, and the commitment of ownership.

- Renting: Advantages include lower initial investment, flexibility, and often, less maintenance responsibility. Disadvantages include the lack of ownership and potential higher long-term costs if rental periods are frequent.

Finding Local Financial Camper Providers

Online search engines, online business directories, and local community forums can be used to find local financial camper providers. Reviews from other businesses or customers can provide valuable insights. Networking with other businesses in your industry can also be beneficial.

Summary Table of Local Providers

This table provides a sample format for summarizing the contact information, pricing, and services of local providers. Actual details will need to be researched and filled in based on your specific needs.

| Provider Name | Contact Information | Pricing Structure | Services Offered |

|---|---|---|---|

| Example RV Dealership | (123) 456-7890, exampledealership@email.com | Variable interest rates, fixed terms | Financing, trade-ins, extended warranties |

| Example Rental Company | (987) 654-3210, examplerental@email.com | Daily/weekly/monthly rates, customizable terms | Short-term rentals, long-term leases, financing options |

Presenting Financial Camper Information

Source: crrhospitality.com

Presenting information about financial campers clearly and engagingly is crucial for attracting potential customers. A well-structured presentation, combined with compelling visuals, can significantly enhance understanding and interest in these unique vehicles. This section details how to effectively convey information about financial campers, focusing on clarity, readability, and visual appeal.

Effective communication is paramount when presenting financial camper information. Clear, concise descriptions of key features, coupled with visually engaging elements, create a compelling narrative for prospective buyers.

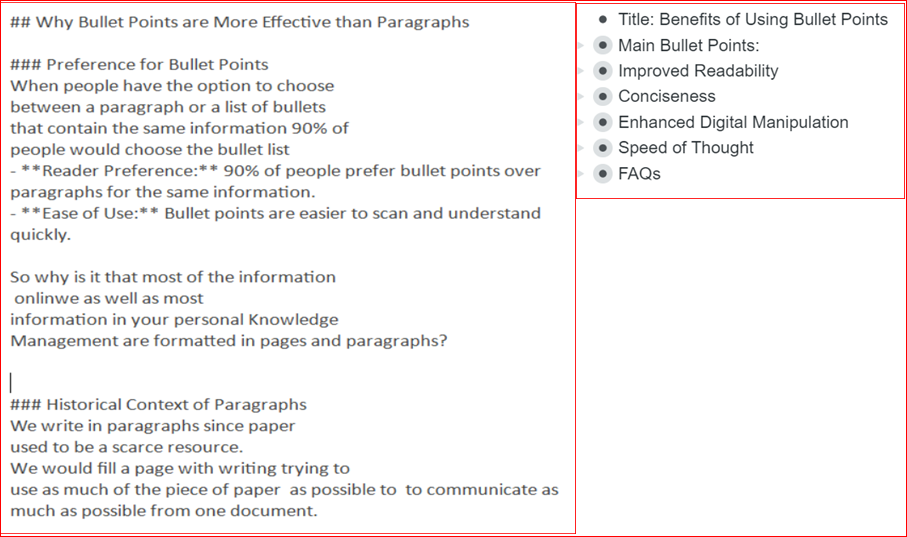

Structuring Information for Clarity and Readability

The layout of the information should prioritize easy navigation and comprehension. Organize features into logical categories such as: exterior design, interior layout, amenities, and technical specifications. Use headings and subheadings to delineate different sections, making the information easily scannable. Break down lengthy descriptions into shorter paragraphs to maintain reader engagement.

Using Visuals to Enhance Presentation, Campers for finance near me

Visual aids are indispensable for presenting financial camper information. Images and videos provide a tangible representation of the camper, showcasing its unique features and appealing aesthetics.

Examples of Using Images and Videos

High-quality images of the camper’s exterior, interior, and key features are essential. Showcase the living space, kitchen, bathroom, and sleeping arrangements. Include images of the camper in various settings, highlighting its versatility. Short, engaging videos can provide a dynamic perspective, demonstrating features like the camper’s maneuverability or the ease of setting up camp. For instance, a video could showcase the kitchen’s functionality by demonstrating how to prepare a meal. Another video could highlight the comfort and space of the sleeping area.

Table of Key Features of Financial Camper Models

This table displays key features of different financial camper models, accompanied by representative images.

| Model | Image Description | Key Features |

|---|---|---|

| Model A | A sleek, modern camper with a panoramic sunroof, showcasing a spacious interior. | Solar panels, high-end appliances, a large living area, spacious bathroom |

| Model B | A classic, cozy camper with a wood-paneled interior, highlighting rustic charm. | Wood accents, wood-burning stove, ample storage, comfortable seating |

| Model C | A compact, maneuverable camper with a focus on fuel efficiency. | Lightweight design, efficient fuel consumption, small footprint, versatile layout |

Presenting Financial Camper Information in a Blog Post

Blog posts offer a flexible platform for presenting information about financial campers. A blog post could feature an overview of the camper’s key features, highlighting the cost-effectiveness of the investment. Include detailed descriptions of each model, emphasizing its unique selling points. Incorporate visuals such as images, videos, and even short, animated explainer videos. Use bullet points and short paragraphs to emphasize key information. For instance, a blog post could compare the energy efficiency of different models or discuss the long-term cost savings of owning a financial camper.

Layout Options for a Webpage Showcasing Financial Campers

A webpage dedicated to financial campers should prioritize user experience. A clean, modern design with high-quality images is essential. Consider using a carousel to display multiple camper models, allowing users to quickly browse different options. Employ a filter system for users to easily narrow down their search based on specific criteria like budget, size, or amenities. The webpage should feature clear calls to action, guiding users toward contact information or further information.

Using Bullet Points and Short Paragraphs to Highlight Key Information

Use bullet points to list key features, highlighting the unique aspects of each model. Use short paragraphs to describe the features and functionalities of each camper. This allows for a quick scan of the available options. For example, a bullet point list might highlight features like off-grid capability, solar panel integration, or the number of beds. Concise descriptions of these features within the paragraphs below each bullet point will provide more detail.

Addressing User Questions and Concerns

Potential campers are often curious about the practical aspects of owning or renting a financial camper. Understanding their concerns and providing clear, concise answers builds trust and encourages a smooth transition into the process. This section delves into common queries and concerns, addressing potential anxieties related to ownership, pricing, availability, and maintenance.

Potential User Questions about Financial Campers

Users may have a variety of questions about financial campers. These inquiries range from the specifics of ownership to the practicalities of maintenance and pricing. Addressing these questions head-on fosters a positive user experience and builds confidence in the financial camper process.

Answers to Common Questions about Financial Camper Ownership

Financial campers, like any investment, come with certain responsibilities. Understanding the commitment involved is crucial for potential owners. This involves factors such as insurance, potential maintenance costs, and long-term upkeep. The decision to own versus rent a financial camper should be carefully considered based on individual needs and financial goals.

Purchasing vs. Renting a Financial Camper

The decision to buy or rent a financial camper depends heavily on individual circumstances. Purchasing offers greater control and potential for long-term gains, but entails higher upfront costs and ongoing maintenance responsibilities. Renting provides more flexibility with lower upfront costs, but potentially limits control and profit potential. A comprehensive evaluation of personal financial goals and lifestyle preferences is essential.

Common Concerns and Solutions

Potential concerns surrounding financial campers frequently revolve around pricing, availability, and maintenance. A transparent approach to pricing and readily available information on maintenance needs can alleviate these concerns.

Addressing Concerns about Price, Availability, and Maintenance

Price concerns can be addressed by providing clear and comprehensive pricing models, showcasing different tiers and features. Transparency regarding availability through an online platform and real-time updates on inventory levels helps manage user expectations. Highlighting potential maintenance costs and providing access to resources for routine maintenance and repair ensures users are prepared for the responsibilities of ownership.

FAQ

| Question | Answer |

|---|---|

| What are the typical maintenance costs for a financial camper? | Maintenance costs vary depending on the type and age of the camper. Regular servicing, such as routine checks and repairs, should be anticipated. Budgeting for these expenses is crucial. |

| How can I ensure the financial camper I choose is properly insured? | Comprehensive insurance coverage is essential. Consult with an insurance provider specializing in financial campers to understand the specific coverage options and ensure adequate protection against potential risks. |

| What are the procedures for securing a financial camper? | Secure booking procedures are in place to ensure smooth transactions. Potential buyers will be guided through a step-by-step process. |

| How can I compare different financial camper models? | A comprehensive comparison tool will assist users in evaluating various models based on key features, specifications, and pricing. |

| Are there financing options available for financial campers? | Financial institutions and specialized lenders may offer financing options for purchasing a financial camper. Inquiries regarding financing options are encouraged. |

Wrap-Up

In conclusion, finding the right camper for your financial needs is a multifaceted process. This guide has explored the search intent behind “campers for finance near me,” examined various financial camper models, and analyzed local providers. By understanding your needs, comparing options, and considering local factors, you’ll be well-equipped to make an informed decision. Whether you’re looking for a weekend getaway or a more permanent living arrangement, this guide provides the insights you need to find the perfect fit for your financial goals and lifestyle. Remember to carefully weigh the costs and benefits of buying or renting, and research local providers thoroughly before committing to any option.